Table of Contents

Understanding Bank Loan and EMI Calculators: A Smart Tool for Financial Planning

Introduction

In today’s fast-paced world, loans are a common way to achieve financial goals—whether it’s buying a home, car, or managing personal expenses. However, before taking a loan, it’s crucial to plan repayments carefully. This is where a Bank Loan and EMI Calculator becomes an indispensable tool. These calculators help you estimate monthly installments, total interest, and repayment schedules, making loan management hassle-free.

What is a Bank Loan Calculator?

A bank loan calculator is a tool designed to estimate the repayment structure for loans. It provides insights into how much you’ll need to pay each month, enabling you to budget effectively.

Types of Bank Loan Calculators:

- Home Loan Calculator

- Personal Loan Calculator

- Car Loan Calculator

- Education Loan Calculator

What is an EMI Calculator?

An Equated Monthly Installment (EMI) Calculator focuses on determining the fixed amount payable every month towards loan repayment. This ensures a clear understanding of monthly commitments.

EMI Formula:

EMI=P×R×(1+R)N(1+R)N−1EMI = \frac{P \times R \times (1+R)^N}{(1+R)^N-1}

Where:

- PP: Principal loan amount

- RR: Monthly interest rate (annual rate divided by 12)

- NN: Number of monthly installments

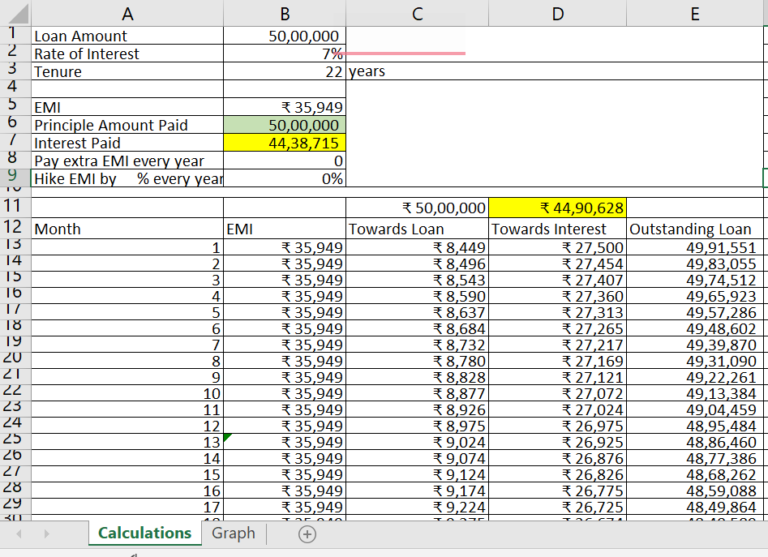

How Does a Bank Loan and EMI Calculator Work?

- Input Parameters:

- Loan Amount: The amount you wish to borrow.

- Interest Rate: Annual rate offered by the bank.

- Loan Tenure: Duration of the loan in months or years.

- Calculation Process:

- The tool uses the formula to compute EMI, total interest, and repayment amount.

- Many calculators also show an amortization schedule, detailing principal and interest breakup for each installment.

- Output:

- Monthly EMI

- Total Interest Payable

- Total Repayment Amount

Benefits of Using a Bank Loan and EMI Calculator

- Ease of Use:

Quick and simple interface requiring minimal inputs. - Accurate Planning:

Helps determine the loan affordability based on your income. - Comparison Tool:

Compare loan options across banks by altering interest rates and tenures. - Real-Time Updates:

Instant recalculations allow for better financial forecasting. - Transparent Budgeting:

Visual aids like graphs or schedules enhance clarity about repayment plans.

Types of Loans You Can Calculate

- Home Loans:

Plan your dream home purchase with precision. - Personal Loans:

Ideal for managing unexpected expenses or personal needs. - Car Loans:

Know the exact cost of financing your vehicle. - Education Loans:

Strategize repayments for academic expenses. - Business Loans:

Evaluate funding options for expanding or starting a business.

Step-by-Step Guide to Using a Bank Loan and EMI Calculator

- Select Loan Type:

Choose the appropriate calculator for your loan (home, car, personal, etc.). - Enter Details:

Input loan amount, interest rate, and tenure. - Analyze Results:

Review the EMI, total interest payable, and overall repayment amount. - Adjust Variables:

Experiment with different interest rates or tenures to find a comfortable EMI.

Real-Life Example

Let’s say you’re planning a personal loan of ₹10,00,000 at an annual interest rate of 10% for a tenure of 5 years.

Input:

- Loan Amount: ₹10,00,000

- Interest Rate: 10%

- Tenure: 60 months

Output:

- EMI: ₹21,247

- Total Interest: ₹2,74,820

- Total Repayment: ₹12,74,820

This gives you a clear idea of the financial commitment involved.

Factors Affecting Loan EMIs

- Loan Amount:

Higher loan amounts result in higher EMIs. - Interest Rate:

Even a small change in interest rates significantly impacts EMIs. - Tenure:

Longer tenures reduce monthly EMIs but increase total interest payable. - Loan Type:

Fixed vs. floating interest rates affect EMI stability.

Advantages of Online EMI Calculators

- Accessibility:

Available 24/7 on bank websites or mobile apps. - Time-Saving:

Eliminates manual calculations. - Interactive Tools:

Visual graphs show interest vs. principal repayment trends. - Custom Scenarios:

Adjust variables like prepayment or rate changes to see the impact.

Common Mistakes to Avoid

- Ignoring Processing Fees:

Always account for these in your budget. - Not Considering Floating Rates:

These can vary, affecting your repayment amount. - Relying Solely on EMIs:

Evaluate the total interest outgo for a comprehensive understanding. - Choosing an Unrealistic Tenure:

Short tenures can strain finances, while longer ones increase interest costs.

Popular Bank Loan and EMI Calculators

Many banks and financial institutions offer online calculators:

- SBI Loan Calculator

- HDFC EMI Calculator

- ICICI Personal Loan Tool

- Axis Bank Loan Estimator

These tools are free, user-friendly, and accurate.

Future Trends in Loan Calculators

The integration of AI and machine learning will make these tools smarter, offering predictive analysis and personalized recommendations. Expect features like voice-enabled inputs and blockchain-based security enhancements in the coming years.

Conclusion

Bank Loan and EMI Calculators are invaluable for anyone planning to take a loan. By simplifying complex calculations, these tools empower users to make informed decisions and maintain financial stability. Whether you’re financing a car, home, or education, leveraging these calculators ensures you’re on the right track.

FAQs

- What is the main purpose of an EMI calculator?

To estimate the monthly installment amount for loan repayment. - Are EMI calculators free to use?

Yes, most are free and available on bank websites or apps. - Can I use an EMI calculator for multiple loan types?

Absolutely, many calculators cater to different loans like home, personal, and car loans. - How accurate are online EMI calculators?

They provide near-accurate results based on your inputs. However, consider processing fees and floating rates for a complete picture. - Can I calculate EMIs offline?

Yes, but it involves manual effort and a deeper understanding of formulas.

**Please don’t forget to leave a review.