Dearness Allowances

In the world of government jobs, salaries are more than just a basic pay scale. Alongside regular wages, employees receive a variety of financial benefits meant to ease their cost of living. One of the most important components of a government employee’s salary package in India is the Dearness Allowances (DA). This allowance is designed to protect government employees from the rising cost of living due to inflation. Let’s dive deeper to understand what Dearness Allowance is, why it matters, and how it affects the lives of employees and pensioners.

What is Dearness Allowances?

Dearness Allowances, commonly known as DA, is a cost of living adjustment paid to government employees, public sector employees, and pensioners. It is calculated as a percentage of an employee’s basic salary to offset the impact of inflation. Since the cost of essential goods and services changes frequently, this allowance ensures that employees can maintain their standard of living despite market fluctuations.

In simple terms, DA acts as a financial cushion that safeguards salaries from losing value over time.

Why is Dearness Allowance Important?

The prices of essential items such as food, clothing, healthcare, and transportation do not remain constant. They tend to increase gradually due to inflation. Without DA, the real value of an employee’s salary would decrease, reducing their purchasing power.

Dearness Allowance plays a vital role in:

Maintaining a reasonable standard of living for employees and pensioners.

Protecting them from the adverse effects of inflation.

Helping employees plan their finances better by adjusting their income according to the market conditions.

It is a critical tool for ensuring financial stability, especially for retired personnel who rely on fixed pensions.

Types of Dearness Allowance

There are primarily two types of DA provided in India:

Industrial Dearness Allowance (IDA):

Paid to employees of public sector enterprises. The IDA is revised quarterly, based on the All-India Consumer Price Index (AICPI).Central Dearness Allowance (CDA):

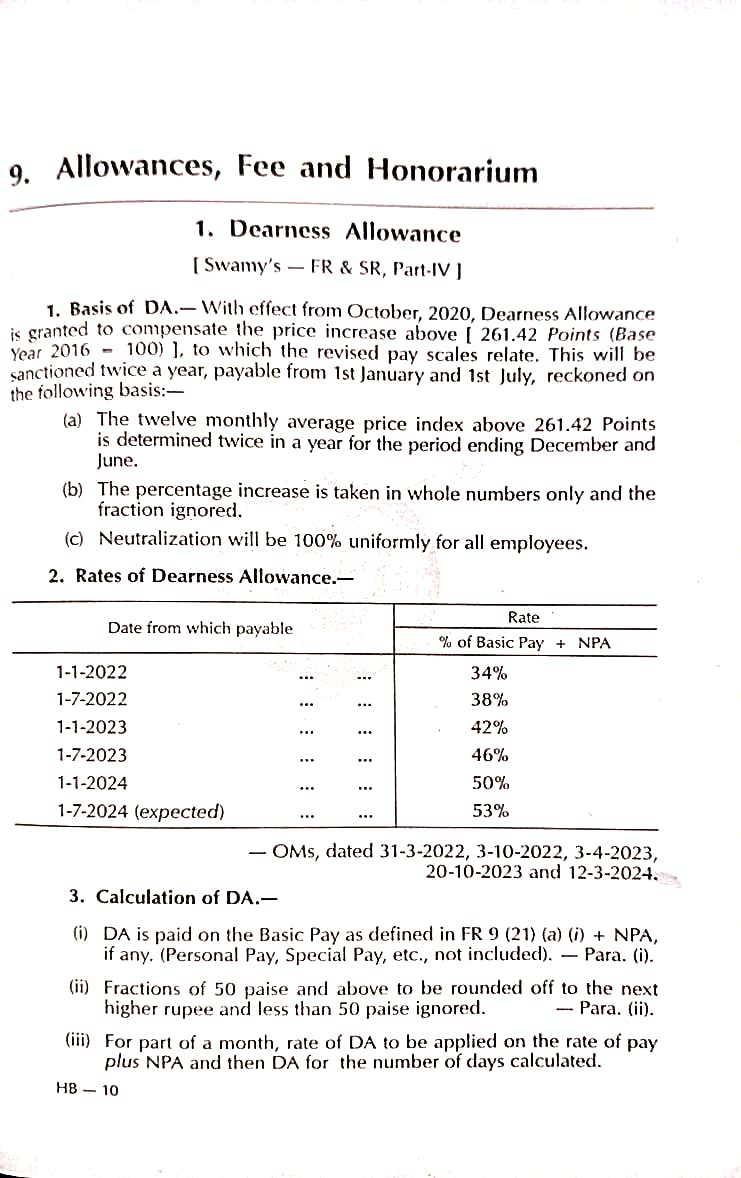

Paid to central government employees, including defense personnel and pensioners. It is revised twice a year — typically in January and July — also based on AICPI figures.

Both types serve the same purpose but differ in terms of their calculation formula and frequency of revision.

How is Dearness Allowance Calculated?

The calculation of DA is directly linked to the Consumer Price Index (CPI), which reflects changes in the prices of essential goods and services consumed by the general public.

The government uses a specific formula to determine the percentage increase or decrease in DA. While the exact formula can vary for IDA and CDA, it essentially tracks inflationary trends and adjusts the allowance accordingly.

For example:

If inflation rises significantly over a period, the DA percentage is increased to match the additional cost burden faced by employees. This adjustment helps bridge the gap between rising expenses and fixed income.

Dearness Allowance for Pensioners

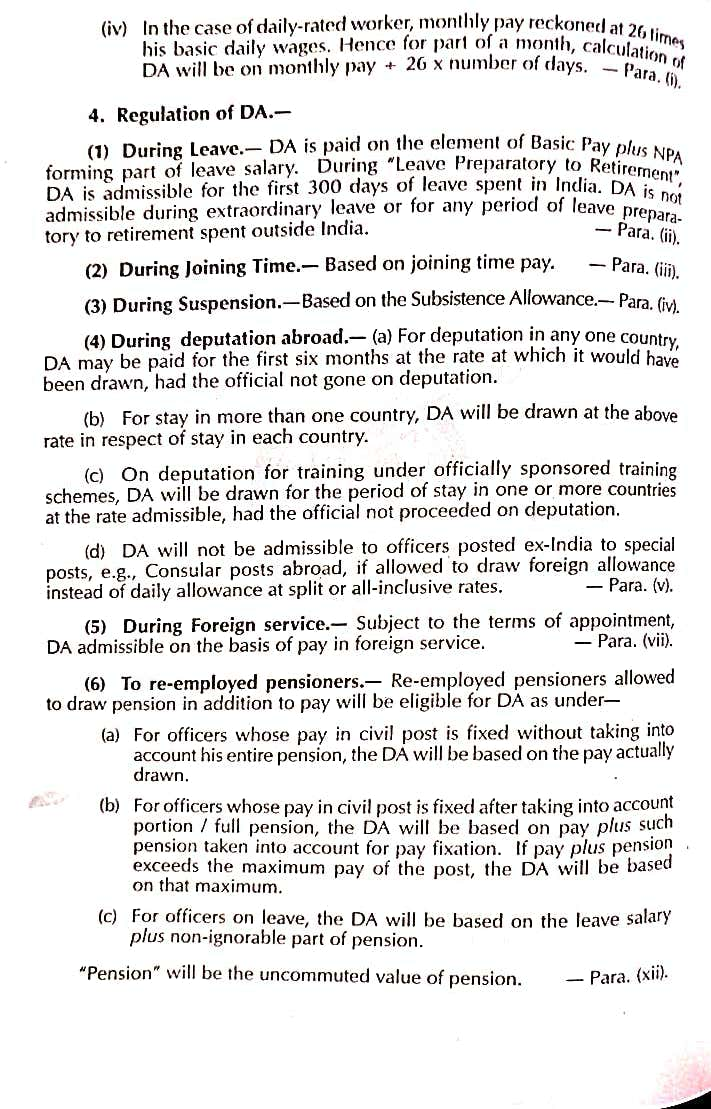

Pensioners are equally affected by inflation since their post-retirement income remains largely fixed. To address this, the government extends DA benefits to pensioners too. Whenever there’s a DA hike for serving government employees, a corresponding increase is announced for pensioners.

This ensures that retired personnel can maintain a reasonable standard of living despite not having an active income source.

Recent Updates on Dearness Allowance

Over the years, the Indian government has regularly revised DA rates to keep up with inflation. For instance, after a temporary freeze during the COVID-19 pandemic, the government resumed DA hikes, providing much-needed relief to employees and pensioners.

As of the latest announcements, central government employees enjoy DA rates of over 50% of their basic pay, with revisions made biannually. This continuous adjustment ensures financial protection for the workforce.

Taxability of Dearness Allowance

It’s important to note that Dearness Allowance is fully taxable. For salaried individuals, it is added to their income and taxed according to the applicable income tax slab. In cases where rent-free accommodation is provided by the employer, a portion of DA might be considered for calculating perquisites.

Thus, while DA offers financial relief, it also increases the taxable income of an individual.

Difference Between Dearness Allowance and Other Allowances

Many people confuse DA with other types of allowances like House Rent Allowance (HRA) or Travel Allowance (TA). However, there’s a clear difference:

Dearness Allowance is meant to counter inflation and is linked to the Consumer Price Index.

Other allowances are paid to meet specific expenses like house rent, medical bills, or travel costs.

DA is universal for all employees, while other allowances depend on the employee’s location, job profile, or personal circumstances.

Conclusion

Dearness Allowance is one of the most significant financial benefits offered to government employees and pensioners in India. It ensures that their salaries and pensions retain their value in the face of ever-increasing inflation. By linking it to the Consumer Price Index and revising it regularly, the government provides a financial safeguard to its workforce.

While it may appear as just a percentage added to the basic salary, DA plays a crucial role in maintaining financial security for millions of families across the country. For both active employees and pensioners, this allowance is a reliable defense against the unpredictable nature of rising prices.

Please don’t forget to leave a review.

The information provided on this blog is for general informational purposes only. All content is provided in good faith; however, we make no representation or warranty of any kind regarding the accuracy or completeness of any information.

Click here to Download in PDF

Disclaimer:

This blog post is intended for informational purposes only. All rights, references, and credits related to official government service rules and guidelines belong to Swamy’s Publications, the authoritative source on these matters. We acknowledge and extend our courtesy to Swamy’s Publication for their valuable work in compiling and publishing official content. This blog does not claim ownership or authorship of any content originally published by Swamy’s Publications.

For more information and updates please follow the page and don’t forget to leave your comment.