Advances from GPF

If you’re a government employee in India, you’ve likely heard of the General Provident Fund (GPF). It’s not just a savings mechanism—it’s a financial safety net. But what happens when you need some cash urgently, and you don’t want to touch your long-term savings? That’s where advances from GPF come into play. This article explores everything you need to know about these advances—eligibility, procedure, benefits, risks, and more.

What is GPF?

GPF stands for General Provident Fund, a savings scheme designed exclusively for government employees. Every month, a portion of your salary is deducted and added to this fund. Over time, it accumulates and earns interest, creating a substantial nest egg.

Importance of GPF for Government Employees

It’s your personal financial cushion—useful for retirement, big life events, or emergencies. But sometimes, you need access to your money sooner than expected. That’s where GPF advances can be a lifesaver.

Understanding GPF Advances

Advances from GPF are temporary withdrawals you can make before retirement, with the intention to repay the amount later. Think of it as borrowing from your future self.

Advance vs. Withdrawal – What’s the Difference?

Advance: A short-term, repayable loan from your GPF.

Withdrawal: A permanent deduction, usually allowed under specific circumstances or after a certain service period.

Eligibility Criteria

Wondering if you’re eligible? Here’s the deal:

You must be a permanent government employee.

You should have completed a minimum number of years in service, usually 10 years.

Your purpose should align with allowed categories like medical, education, etc.

Types of GPF Advances

Let’s break down the types:

1. Temporary Advance

This is repayable in fixed monthly installments. The most common type, it’s useful for minor but urgent expenses.

2. Recovery-Based Advances

You borrow, you repay—simple. These advances are repaid in equal monthly installments, typically over 12–24 months.

3. Non-Refundable Advances

Allowed after a certain period of service (usually 20 years) or under specific conditions, these don’t need to be repaid.

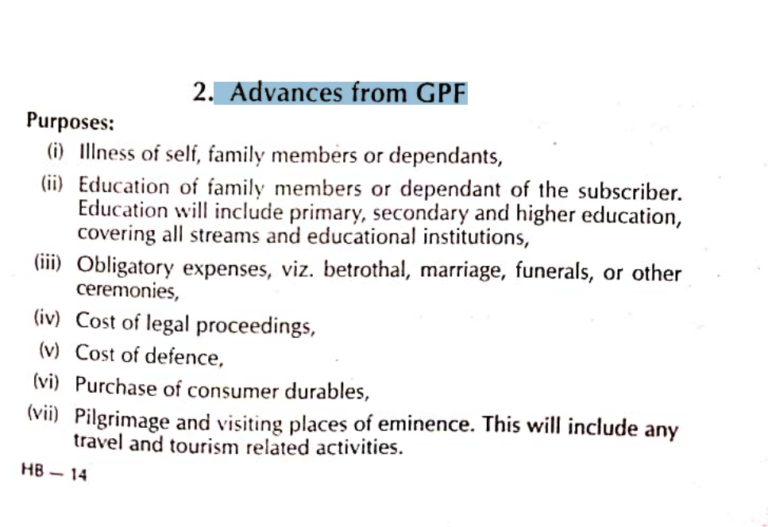

Reasons for Granting Advances

Here are the common purposes approved by the government:

Medical Emergencies – For self or dependent family members

Higher Education – College, vocational training, or professional courses

Marriage Expenses – For self or children

House Repairs or Construction – Property-related investments

Purchase of Consumer Goods – Laptops, vehicles, etc., under specific limits

Procedure to Apply for GPF Advance

Getting your GPF advance is easier than you think.

Step-by-Step Process:

Submit the application to your head of department or online portal.

Include purpose and amount required.

Attach necessary documents.

Await verification and approval.

Documents Required:

Application form

Service record

Proof of purpose (e.g., medical bills, education admission letter)

Online vs Offline:

Most departments now encourage online submissions for faster processing. It’s quicker, paperless, and transparent.

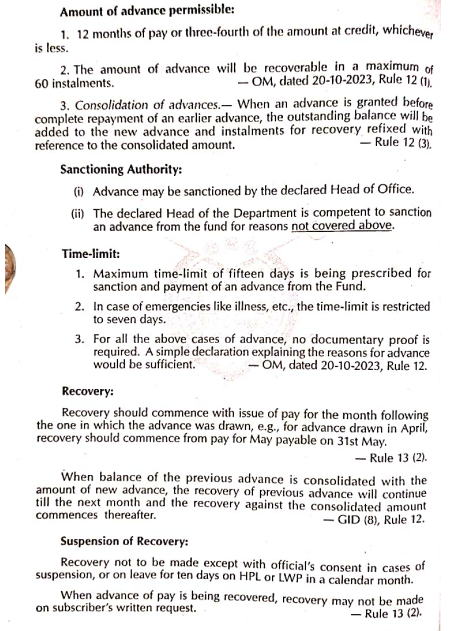

GPF Rules and Guidelines

The government has strict rules to prevent misuse:

Maximum limit usually up to three months’ salary or half of the GPF balance.

Advance repayment must start immediately after disbursement.

Interest is not charged unless the advance is not repaid in time.

Tax Implications

Good news—GPF advances are not taxable. However, your overall GPF contributions and withdrawals may be considered for tax calculations under Section 80C.

Benefits of GPF Advance

No Interest Loans – Why take an expensive bank loan?

Quick Approval – Especially in emergencies

No Credit Score Impact – You’re borrowing from your own savings

Risks and Considerations

Repayment Load – Monthly deductions can pinch

Lower GPF Corpus – You’re reducing your future funds

Recent Reforms and Digitalization

Gone are the days of standing in long lines. The government has launched online GPF management portals making the entire process digital, traceable, and fast.

Click here to Download in PDF

Tips to Manage Your GPF Wisely

Use GPF advance only for important needs

Maintain a balance for future emergencies

Don’t treat it like an ATM—it’s your retirement lifeline

Case Study: Real-Life Scenario

Meet Ramesh, a central government employee who needed ₹1.5 lakh for his daughter’s college admission. Instead of running to a bank, he applied for a GPF advance online. Within 7 days, the amount was credited, and he repaid it in 18 installments—no interest, no hassle.

Conclusion

GPF advances are a great tool for managing mid-career financial needs without depending on outside loans. If used responsibly, they can help you sail through life’s unexpected moments without draining your savings.

FAQs

1. What is the maximum amount I can get as a GPF advance?

You can typically get up to 50% of your GPF balance or three months’ salary, whichever is less.

2. Can I take a GPF advance multiple times?

Yes, but you must complete repayment of the previous advance before applying again.

3. Is there any interest on GPF advances?

No, there’s no interest if repaid on time.

4. How long does it take to process a GPF advance?

It usually takes 7 to 15 days, depending on your department and the completeness of your documents.

5. Can I apply for a GPF advance online?

Yes! Most departments now accept online applications, speeding up the approval process.

Please don’t forget to leave a review.

Disclaimer:

This blog post is intended for informational purposes only. All rights, references, and credits related to official government service rules and guidelines belong to Swamy’s Publications, the authoritative source on these matters. We acknowledge and extend our courtesy to Swamy’s Publication for their valuable work in compiling and publishing official content. This blog does not claim ownership or authorship of any content originally published by Swamy’s Publications.

For more information and updates please follow the page and don’t forget to leave your comment.