Dress Allowance for Central Government Employees in India

Dress Allowance stands out as a significant benefit, especially for personnel required to wear specific uniforms while on duty.

The Central Government of India provides a wide range of allowances to its employees to ensure their well-being, dignity, and smooth functioning in their respective roles. It is not just about appearance—dress allowance supports professionalism, discipline, and role identification across various government departments.

The Dress Allowance is a consolidated amount paid annually to central government employees who are required to wear a uniform during their service. This includes officials from the armed forces, paramilitary forces, police services, medical staff, and other departments such as customs and excise, where a uniform is mandatory. The allowance is intended to cover the cost of purchasing and maintaining the prescribed attire, ensuring employees uphold the dignity of their roles with the appropriate dress code.

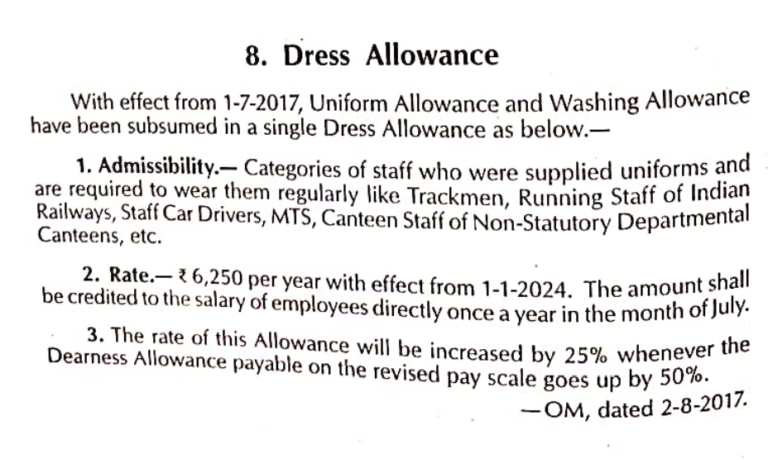

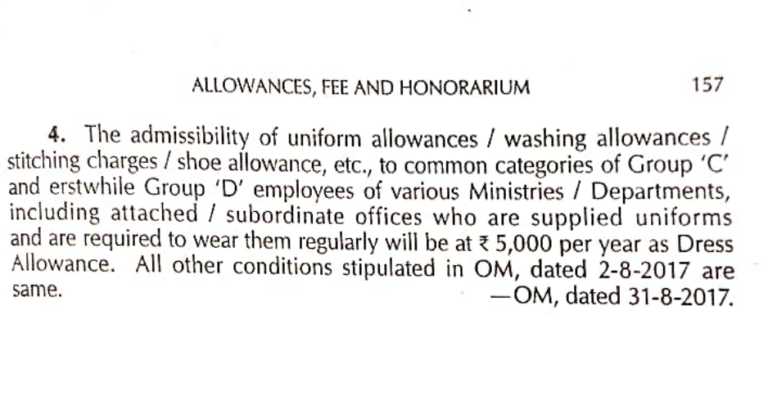

This allowance replaced several older clothing-related benefits following the recommendations of the 7th Central Pay Commission. Earlier, employees were granted Uniform Allowance, Kit Maintenance Allowance, and Washing Allowance separately. The 7th CPC streamlined these into a single Dress Allowance for simplification and ease of disbursement. The revised allowance is directly credited to employees’ accounts once a year, usually in July.

The amount of dress allowance varies depending on the employee’s role and the department they serve in. For instance:

₹20,000 per annum is granted to officers of the Indian Navy, Indian Army, and Indian Air Force (who wear ceremonial dress).

₹10,000 per annum is given to personnel in Central Armed Police Forces like BSF, CRPF, CISF, ITBP, etc.

₹5,000 per annum is provided to personnel in the Police, Indian Coast Guard, and similar services.

₹1,800 per annum is allotted to other staff like nurses or paramedical staff required to wear prescribed uniforms.

This allowance is taxable as per income tax rules and is disbursed irrespective of whether the employee actually purchases the uniform. However, in most departments, failure to wear the proper attire can result in disciplinary actions. Therefore, the allowance indirectly ensures compliance with dress codes and upholds the image of government institutions.

To be eligible for the dress allowance, employees must fulfill the following conditions:

Belong to a category where a uniform is compulsory.

Be actively serving in a post that mandates a dress code.

Have completed the necessary documentation or declaration as per departmental norms.

Unlike some other allowances, the dress allowance is not linked to location or posting. Whether an employee is serving in a metro city, rural post, or a border area, the allowance remains the same, provided their role mandates a uniform. It ensures parity and uniformity across regions.

The rationale behind this allowance goes beyond just clothing. In roles like police, paramilitary forces, and health services, uniforms are a symbol of authority, responsibility, and service. A smartly dressed official not only commands respect but also instills confidence in the public. By covering uniform costs, the government ensures that personal finances do not become a hurdle for employees in maintaining a presentable appearance.

Moreover, in recent years, there has been a push towards better quality uniforms, especially in frontline roles. For example, the Ministry of Defence and the Ministry of Home Affairs have taken steps to standardize the material and design of uniforms across forces. The dress allowance supports this initiative by giving employees the financial support to procure uniforms as per upgraded standards.

One concern often raised is the adequacy of the allowance in keeping up with inflation and the rising cost of materials. In metropolitan areas, the cost of tailoring, fabric, and accessories often surpasses the allocated amount. Additionally, certain roles require multiple sets of uniforms for different seasons, increasing the overall expenditure. Employee unions and associations have, from time to time, urged the government to revise the rates periodically to reflect market realities.

Furthermore, some departments have expressed the need for separate uniform procurement mechanisms or reimbursements based on actual bills, rather than fixed allowances. However, the fixed allowance system remains popular due to its simplicity, minimal paperwork, and quicker disbursal.

In conclusion, the Dress Allowance for Central Government Employees in India is a practical and thoughtful component of the overall service benefits. It empowers employees to maintain the dignity of their roles through proper attire while also promoting discipline and a sense of identity within departments. Though there is room for revision and improvement, especially in light of rising costs, the allowance continues to serve its purpose effectively. As government services evolve and uniforms get modernized, it is only fitting that this allowance be periodically updated to keep pace with the needs of those who serve the nation with pride—uniforms on, and heads held high.

FAQs

1. Who is eligible for the Dress Allowance?

Employees of the central government whose roles require a compulsory uniform, such as police, defense, paramilitary forces, nurses, and certain customs officials.

2. How is the Dress Allowance paid?

It is paid as a lump sum once a year, typically in July, and is credited directly to the employee’s salary account.

3. Is the Dress Allowance taxable?

Yes, the dress allowance is subject to income tax as per applicable tax laws.

4. Can an employee claim more than one dress allowance?

No. An employee is eligible for only one dress allowance per year, even if posted to multiple roles requiring different uniforms.

5. Will the Dress Allowance increase over time?

Currently, there is no automatic provision for an annual increase. However, the government may revise the allowance based on future pay commission recommendations or departmental reviews.

Please don’t forget to leave a review.

Disclaimer:

This blog post is intended for informational purposes only. All rights, references, and credits related to official government service rules and guidelines belong to Swamy’s Publications, the authoritative source on these matters. We acknowledge and extend our courtesy to Swamy’s Publication for their valuable work in compiling and publishing official content. This blog does not claim ownership or authorship of any content originally published by Swamy’s Publications.

For more information and updates please follow the page and don’t forget to leave your comment.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.info/bg/register?ref=V2H9AFPY