FEES AND HONORARIUM FOR CENTRAL GOVT EMPLOYEES IN India

When you’re working in the Central Government of India, things like salary, benefits, allowances, and additional payments are usually governed by clear rules. But there’s an often-overlooked corner of compensation—fees and honorarium—which actually plays a big role in rewarding extra effort and specialized duties.

Fees and Honorarium

Let’s start with the basics. A fee is a payment given for specific services rendered, especially when the task is occasional or temporary. Think of it like getting paid for conducting an official training session or checking exam papers.

On the flip side, an honorarium is more of a gesture—a token payment to acknowledge someone’s contribution beyond their job description. It’s usually offered for voluntary work, like being part of a review committee or giving a guest lecture.

Purpose Behind Paying Fees and Honorarium

Why pay these in the first place? Simple. Government employees often take on duties beyond their regular work, like organizing training sessions or participating in official panels. Paying a fee or honorarium encourages participation, rewards initiative, and ensures that expertise is recognized, even when it’s outside the scope of one’s usual role.

Categories of Central Government Employees

The Central Government workforce is divided into Group A, B, C, and D. These classifications affect everything—from promotions to perks to, yes, the eligibility for receiving fees or honorariums. Typically, employees in Group A and B are more frequently involved in extra tasks like evaluations or project reviews. However, even Group C and D staff can be granted honorariums in certain circumstances.

Guidelines Governing Fees and Honorarium

Two major authorities define the rules:

DoPT (Department of Personnel and Training): Issues circulars regarding the quantum, purpose, and process of honorariums.

Ministry of Finance: Plays a pivotal role in approving higher-value honorariums, especially if they exceed the usual thresholds.

Types of Assignments That Earn Fees or Honorarium

Some common tasks that qualify include:

Examinations and Evaluations: Teachers or officers evaluating papers are typically compensated with a fee.

Committee Participation: Serving as a member of a panel or internal committee often earns you an honorarium.

Guest Lectures: Delivering training programs or speaking at seminars.

Special Project Reports: Drafting reports or contributing to policy whitepapers.

Maximum Limit on Honorarium

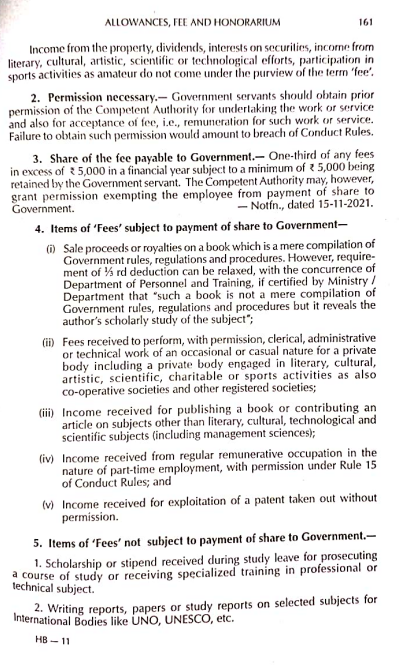

Yes, there’s a cap. The monetary limit varies depending on the task and designation. For anything exceeding the standard limit, prior sanction from the Finance Ministry is mandatory. Honorariums above ₹5,000, for example, often need higher-level approvals.

Approval Process and Sanctioning Authorities

Before any money is paid, the appropriate administrative authority has to clear it. This typically involves sending a proposal to the finance or HR wing of the department, with details of the task, time spent, and amount proposed.

Payment Process and Documentation

Honorariums are paid via the PFMS (Public Financial Management System). You’ll usually need to fill out a standard form, get it signed by the competent authority, and attach supporting documents. Then, voila—your honorarium gets credited!

Tax Implications

Here’s the bummer: Honorarium is taxable under the Income Tax Act. It’s considered “Income from Other Sources” if not part of salary. If the amount exceeds ₹30,000 annually, TDS (Tax Deducted at Source) may apply.

Key Differences: Salary vs Fees vs Honorarium

It’s important to distinguish:

Salary: Fixed monthly income for regular work.

Fee: Payment for occasional, assigned tasks.

Honorarium: Token of appreciation for voluntary work.

Knowing these distinctions helps manage expectations and plan finances accordingly.

Challenges in Honorarium Disbursement

Delays: Due to red tape or missing documentation.

Lack of Awareness: Many employees don’t even know they can claim an honorarium for their work.

Real-Life Examples

Consider a university professor evaluating civil service exam papers or an officer compiling a disaster management report. Both are eligible for separate compensation over and above their salary.

Transparency and Fair Practices

To avoid favoritism, departments are encouraged to publish honorarium opportunities, standardize payment amounts, and rotate assignments.

Future Trends and Reforms

The government is moving towards digitizing the process. Soon, approval, tracking, and disbursement could be handled via a unified dashboard. AI may also help identify eligible employees based on roles and past assignments.

Conclusion

Fees and honorarium might not be the headline-makers in government employment, but they’re crucial for recognizing and rewarding the extra effort. Whether you’re evaluating exams or lending your expertise to a policy committee, these payments ensure that your work doesn’t go unnoticed. Knowing your rights and the process can make all the difference. So, the next time you’re assigned something beyond your usual job—check if you’re eligible for a little something extra.

FAQs

1. Can contractual employees receive honorarium?

Usually, no. Honorariums are primarily meant for regular government employees, unless a contract explicitly allows it.

2. How long does it take to process the payment?

Typically 15–30 days after submission of documents, depending on departmental workflow.

3. Is honorarium paid monthly?

No, it is a one-time or occasional payment for specific tasks.

4. Can an employee refuse to accept it?

Yes, accepting an honorarium is not mandatory. Employees can decline it.

5. Is honorarium the same in all departments?

Not exactly. While the framework is similar, departments may vary in implementation and limits.

Please don’t forget to leave a review.

Disclaimer:

This blog post is intended for informational purposes only. All rights, references, and credits related to official government service rules and guidelines belong to Swamy’s Publications, the authoritative source on these matters. We acknowledge and extend our courtesy to Swamy’s Publication for their valuable work in compiling and publishing official content. This blog does not claim ownership or authorship of any content originally published by Swamy’s Publications.

For more information and updates please follow the page and don’t forget to leave your comment.