Table of Contents

ISLAND SPECIAL DUTY ALLOWANCE

Island Special Duty Allowance (ISDA): A Unique Incentive for Tough Postings

Working in island regions might sound like a vacation to some, but for government employees and defense personnel, it’s often far from a tropical paradise. That’s where the Island Special Duty Allowance (ISDA) steps in — as a crucial financial perk to support those posted in remote and challenging island locations.

What is Island Special Duty Allowance (ISDA)?

ISDA is a special monetary benefit granted to government employees posted in remote island territories of India. These areas, often cut off from mainland amenities, pose unique challenges like isolation, difficult terrain, and limited access to healthcare, education, and transport.

Background of ISDA

The allowance was introduced to ensure fairness in compensation and encourage staff to willingly accept postings in India’s isolated islands. It has evolved over time through various Pay Commissions, and today it remains an integral part of incentive structures for such postings.

Who is Eligible for ISDA?

Eligibility typically includes:

Central Government Employees posted in specified island territories

Defense Personnel, including Navy and Coast Guard

All India Services (IAS, IPS, IFS) stationed in island regions

Geographical Scope

ISDA is limited to postings in the following key island groups:

These territories are known for their beauty but also their infrastructural challenges, making compensation crucial.

How ISDA Works

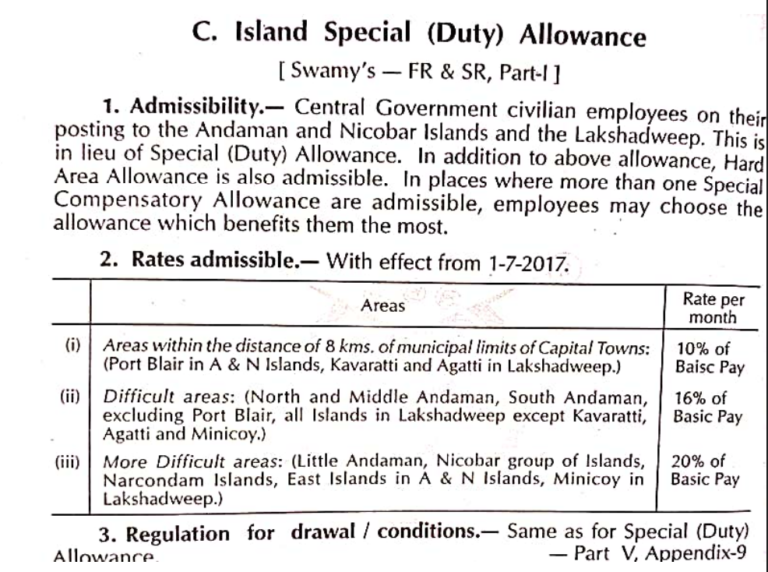

The allowance is calculated as a percentage of basic pay, often ranging between 10% to 20%, depending on the hardship level of the location. Remote or non-accessible islands tend to have a higher rate than those with better connectivity.

ISDA vs Other Allowances

Unlike the Hardship Allowance or Field Area Allowance, ISDA is location-specific and strictly tied to designated island territories. It’s not meant for difficult terrain alone but also for the isolation factor and lack of regular civic infrastructure.

Benefits of ISDA

Boosts morale for those stationed away from family and urban life

Acts as a compensation for restricted lifestyle

Encourages voluntarism for island postings

Challenges Faced by Personnel in Island Areas

Being stationed on remote islands comes with:

Poor communication networks

Limited healthcare and education

Lack of recreational facilities

Supply chain delays

These challenges justify the need for a dedicated allowance like ISDA.

ISDA as a Compensation Mechanism

In economic terms, ISDA helps bridge the lifestyle cost gap between mainland and isolated areas. It functions not only as a financial cushion but also as a retention tool, reducing reluctance among employees for island postings.

Calculation of ISDA

The formula generally involves:

A fixed percentage (e.g., 20%) of the Basic Pay

Additional DA (Dearness Allowance) is sometimes included

Varies based on location and level of hardship

ISDA in 7th Pay Commission

The 7th CPC retained the ISDA with some revisions:

ISDA now applies at a fixed percentage of revised pay

Adjusted to align with inflation and modern-day costs

For instance, employees in Andaman & Nicobar may receive 20% of Basic Pay, while others in more accessible areas may receive 10%.

Tax Implications of ISDA

One of the common queries — Is ISDA taxable?

Yes, ISDA is taxable as part of the salary income, and must be declared in your ITR. However, certain rebates and deductions might apply depending on the overall income bracket.

Policy Updates and Government Orders

The Ministry of Finance and DoPT issue circulars from time to time to:

Revise ISDA rates

Clarify eligibility

Include new zones if needed

Keeping track of these notifications is essential for HR departments and employees alike.

Controversies and Demands for ISDA

There have been several calls to:

Increase the allowance amount to match rising costs

Extend ISDA to more personnel categories

Include semi-isolated coastal areas that also face similar hardships

Unions and service associations have time and again pushed for these reforms.

The Future of ISDA

As India continues to develop its far-flung territories, ISDA might see:

Expansion to new regions

Higher allowance rates

Better facilities and digital compensation tracking

Government attention toward remote areas may also reduce reliance on ISDA in the long run — but until then, it remains a vital financial incentive.

Conclusion

Island Special Duty Allowance (ISDA) is more than just a number on a payslip — it’s a recognition of the commitment shown by government employees and defense personnel serving in India’s remotest corners. It reflects not just the financial hardship, but also the emotional and social sacrifices made by those who keep the country’s island territories running smoothly.

FAQs

1. Who is eligible for Island Special Duty Allowance?

Central government employees, defense forces, and officers from All India Services posted in notified island territories.

2. Is ISDA applicable to private sector employees?

No, ISDA is strictly for government and armed forces personnel.

3. How much is ISDA in Andaman & Nicobar Islands?

Typically, it’s 20% of the Basic Pay under the 7th Pay Commission.

4. Is ISDA tax-free?

No, it is considered part of taxable income under salary.

5. Can ISDA be combined with other allowances?

Yes, it can be drawn alongside other allowances like DA, HRA, etc., depending on the rules.

Please don’t forget to leave a review.

ISLAND SPECIAL DUTY ALLOWANCE

Island Special Duty Allowance (ISDA): A Unique Incentive for Tough Postings

Working in island regions might sound like a vacation to some, but for government employees and defense personnel, it’s often far from a tropical paradise. That’s where the Island Special Duty Allowance (ISDA) steps in — as a crucial financial perk to support those posted in remote and challenging island locations.

What is Island Special Duty Allowance (ISDA)?

ISDA is a special monetary benefit granted to government employees posted in remote island territories of India. These areas, often cut off from mainland amenities, pose unique challenges like isolation, difficult terrain, and limited access to healthcare, education, and transport.

Background of ISDA

The allowance was introduced to ensure fairness in compensation and encourage staff to willingly accept postings in India’s isolated islands. It has evolved over time through various Pay Commissions, and today it remains an integral part of incentive structures for such postings.

Who is Eligible for ISDA?

Eligibility typically includes:

Central Government Employees posted in specified island territories

Defense Personnel, including Navy and Coast Guard

All India Services (IAS, IPS, IFS) stationed in island regions

Geographical Scope

ISDA is limited to postings in the following key island groups:

These territories are known for their beauty but also their infrastructural challenges, making compensation crucial.

How ISDA Works

The allowance is calculated as a percentage of basic pay, often ranging between 10% to 20%, depending on the hardship level of the location. Remote or non-accessible islands tend to have a higher rate than those with better connectivity.

ISDA vs Other Allowances

Unlike the Hardship Allowance or Field Area Allowance, ISDA is location-specific and strictly tied to designated island territories. It’s not meant for difficult terrain alone but also for the isolation factor and lack of regular civic infrastructure.

Benefits of ISDA

Boosts morale for those stationed away from family and urban life

Acts as a compensation for restricted lifestyle

Encourages voluntarism for island postings

Challenges Faced by Personnel in Island Areas

Being stationed on remote islands comes with:

Poor communication networks

Limited healthcare and education

Lack of recreational facilities

Supply chain delays

These challenges justify the need for a dedicated allowance like ISDA.

ISDA as a Compensation Mechanism

In economic terms, ISDA helps bridge the lifestyle cost gap between mainland and isolated areas. It functions not only as a financial cushion but also as a retention tool, reducing reluctance among employees for island postings.

Calculation of ISDA

The formula generally involves:

A fixed percentage (e.g., 20%) of the Basic Pay

Additional DA (Dearness Allowance) is sometimes included

Varies based on location and level of hardship

ISDA in 7th Pay Commission

The 7th CPC retained the ISDA with some revisions:

ISDA now applies at a fixed percentage of revised pay

Adjusted to align with inflation and modern-day costs

For instance, employees in Andaman & Nicobar may receive 20% of Basic Pay, while others in more accessible areas may receive 10%.

Tax Implications of ISDA

One of the common queries — Is ISDA taxable?

Yes, ISDA is taxable as part of the salary income, and must be declared in your ITR. However, certain rebates and deductions might apply depending on the overall income bracket.

Policy Updates and Government Orders

The Ministry of Finance and DoPT issue circulars from time to time to:

Revise ISDA rates

Clarify eligibility

Include new zones if needed

Keeping track of these notifications is essential for HR departments and employees alike.

Controversies and Demands for ISDA

There have been several calls to:

Increase the allowance amount to match rising costs

Extend ISDA to more personnel categories

Include semi-isolated coastal areas that also face similar hardships

Unions and service associations have time and again pushed for these reforms.

The Future of ISDA

As India continues to develop its far-flung territories, ISDA might see:

Expansion to new regions

Higher allowance rates

Better facilities and digital compensation tracking

Government attention toward remote areas may also reduce reliance on ISDA in the long run — but until then, it remains a vital financial incentive.

Conclusion

Island Special Duty Allowance (ISDA) is more than just a number on a payslip — it’s a recognition of the commitment shown by government employees and defense personnel serving in India’s remotest corners. It reflects not just the financial hardship, but also the emotional and social sacrifices made by those who keep the country’s island territories running smoothly.

FAQs

1. Who is eligible for Island Special Duty Allowance?

Central government employees, defense forces, and officers from All India Services posted in notified island territories.

2. Is ISDA applicable to private sector employees?

No, ISDA is strictly for government and armed forces personnel.

3. How much is ISDA in Andaman & Nicobar Islands?

Typically, it’s 20% of the Basic Pay under the 7th Pay Commission.

4. Is ISDA tax-free?

No, it is considered part of taxable income under salary.

5. Can ISDA be combined with other allowances?

Yes, it can be drawn alongside other allowances like DA, HRA, etc., depending on the rules.

Please don’t forget to leave a review.

Disclaimer:

This blog post is intended for informational purposes only. All rights, references, and credits related to official government service rules and guidelines belong to Swamy’s Publications, the authoritative source on these matters. We acknowledge and extend our courtesy to Swamy’s Publication for their valuable work in compiling and publishing official content. This blog does not claim ownership or authorship of any content originally published by Swamy’s Publications.