Table of Contents

Travelling Allowances and Rates for Central Govt Employees in India

Outline

Introduction

- Overview of revised allowances and their significance

- Key changes in 2023-2024

What are Central Government Allowances?

- Definition and purpose

- Common types of allowances

Why Were the Allowances Revised?

- Inflation adjustments

- Government policies for employee welfare

Major Revised Allowances

1. Dearness Allowance (DA)

- Percentage increase

- Impact on employees’ pay

2. House Rent Allowance (HRA)

- Changes based on city classification

- Specific percentages for metro, non-metro cities

3. Transport Allowance (TA)

- Updated rates for different categories

- Applicability based on pay level

4. Leave Travel Concession (LTC)

- Revised limits and rules

- Digital submission and reimbursement updates

Additional Perks and Benefits

- Child Education Allowance (CEA)

- Special Duty Allowance (SDA) for North-East employees

Impact of Revised Rates on Employees

- Increase in disposable income

- Effect on savings and lifestyle

How to Calculate Revised Pay and Allowances?

- Tools and calculators provided by the government

- Step-by-step calculation examples

Comparison with Previous Allowances

- Before vs. after scenarios

- Practical examples for clarity

Employee Reactions and Feedback

- Initial opinions from various employee unions

- General sentiment

Future Implications of Allowance Revisions

- Potential trends in future pay commissions

- Broader impact on the Indian economy

Conclusion

- Summary of benefits for employees

- Broader socio-economic benefits

FAQs

- What is the current DA percentage for Central Govt employees?

- How is HRA calculated for metro cities?

- Are LTC claims easier with the new rules?

- What’s the maximum reimbursement under CEA?

- When will the next revision be announced?

Article

Introduction

The central government recently announced revised allowances and rates for its employees, a much-anticipated move that affects millions of workers across the country. These changes, introduced in line with inflationary trends and employee demands, aim to enhance the financial well-being of public servants while aligning with current economic conditions.

What are Central Government Allowances?

Central government allowances are monetary benefits offered to employees over and above their basic pay. They cater to various needs like housing, travel, and education, ensuring employees can maintain a comfortable lifestyle while serving the nation.

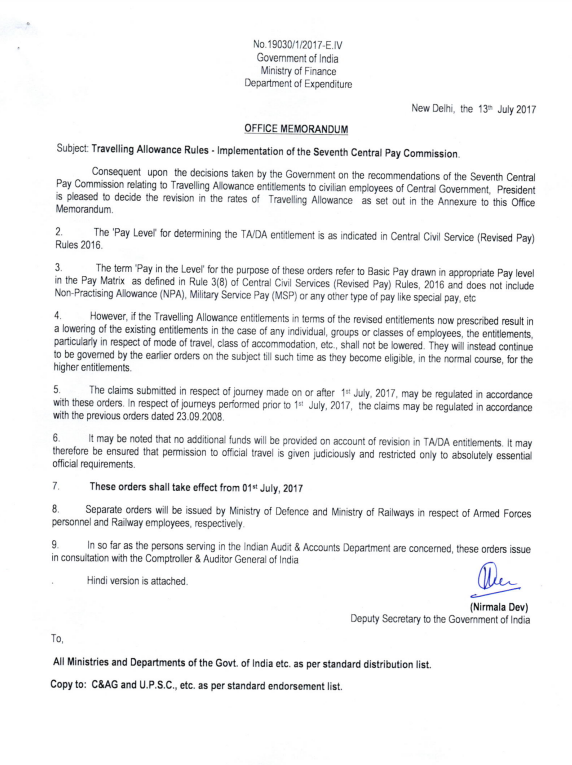

Travelling Allowances

Revisions are periodic and necessary due to inflation, cost-of-living adjustments, and changing economic dynamics. The government strives to ensure its workforce remains motivated and financially secure by addressing these factors.

Major Revised Allowances

1. Dearness Allowance (DA)

The DA was increased from 38% to 42% of the basic pay, effective from July 2023. This hike aims to offset the impact of inflation on employees’ purchasing power, directly boosting their take-home salary.

2. House Rent Allowance (HRA)

HRA continues to vary by city classification. For metro cities like Delhi and Mumbai, it remains at 27% of basic pay, but adjustments have been made for smaller cities to reflect real estate trends.

3. Transport Allowance (TA)

TA has seen incremental changes, particularly for employees stationed in high-traffic metro cities. The revised rates ensure that commuting costs are adequately covered, reducing the financial burden on employees.

4. Leave Travel Concession (LTC)

LTC now includes higher reimbursement limits and simplified submission processes, making it easier for employees to avail themselves of the benefit. The focus on digital submissions is a welcome step towards transparency and efficiency.

Additional Perks and Benefits

- Child Education Allowance (CEA): Increased reimbursement ceilings ensure that employees can better manage their children’s educational expenses.

- Special Duty Allowance (SDA): Employees working in challenging regions like the North-East now receive higher compensatory allowances.

Impact of Revised Rates on Employees

The revisions directly enhance disposable income, enabling employees to allocate more toward savings, investments, or lifestyle improvements. These changes also have ripple effects on the broader economy as consumer spending rises.

How to Calculate Revised Pay and Allowances?

The government has provided online tools to help employees calculate their revised pay. By entering basic pay details, employees can easily determine the updated DA, HRA, and other allowances.

Comparison with Previous Allowances

For instance, an employee earning a basic pay of ₹50,000 will now receive ₹21,000 as DA compared to ₹19,000 earlier, demonstrating a tangible increase in earnings.

Employee Reactions and Feedback

Initial feedback from unions and employees has been overwhelmingly positive. Many expressed relief at the revisions, highlighting the government’s commitment to employee welfare.

Future Implications of Allowance Revisions

These changes set the stage for future adjustments, paving the way for more comprehensive reforms in upcoming pay commissions. On a macro level, such revisions can stimulate economic growth through increased consumption.

Conclusion

The revised allowances and rates for central government employees mark a significant step in addressing the workforce’s financial needs. By bridging the gap between earnings and expenses, these changes not only benefit employees but also contribute positively to the nation’s economic fabric.

FAQs

- What is the current DA percentage for Central Govt employees?

The current DA is 42% of the basic pay, effective from July 2023. - How is HRA calculated for metro cities?

HRA for metro cities is set at 27% of the basic pay. - Are LTC claims easier with the new rules?

Yes, LTC claims are now more straightforward with digital submission processes and updated reimbursement limits. - What’s the maximum reimbursement under CEA?

The maximum reimbursement under the Child Education Allowance is ₹27,000 per annum per child. - When will the next revision be announced?

The next revision is expected in line with the 8th Pay Commission, likely within the next few years.