WITHDRAWALS FROM GPF

General Provident Fund (GPF) is a long-term savings tool for government employees in India. It’s like a personal piggy bank where a portion of your salary goes every month, and the government adds interest. It grows steadily over time and becomes a cushion during tough times.

What is GPF?

GPF stands for General Provident Fund, a savings scheme exclusive to government employees. Under this scheme, a fixed portion of the employee’s salary is deducted and deposited into the fund monthly.

Importance of GPF for Government Employees

GPF plays a pivotal role in ensuring financial stability. Whether it’s for a medical emergency, marriage, or buying a home, GPF withdrawals provide financial backup without needing external loans.

Types of Withdrawals from GPF

Withdrawals from GPF are mainly of two types:

Temporary Withdrawals – These are essentially advances that need to be repaid.

Final Withdrawals – These are non-refundable and usually done close to retirement or for specific needs.

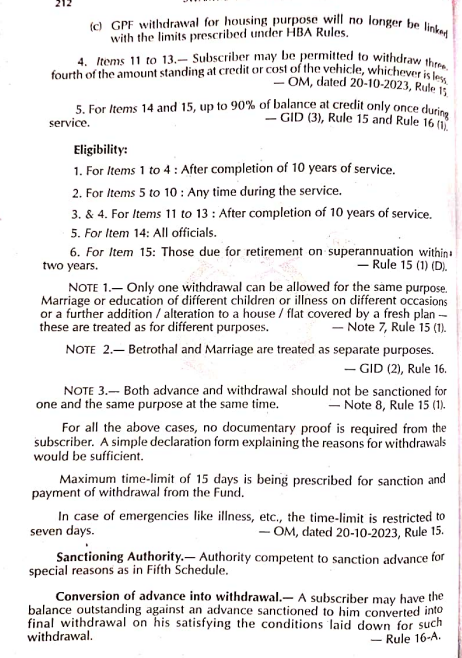

Eligibility Criteria for Withdrawals

Who Can Withdraw from GPF?

Only government employees who have subscribed to GPF for a minimum of 10 years are generally eligible for withdrawal. However, exceptions exist based on circumstances and necessity.

Conditions for Permanent Employees

Permanent government employees are entitled to withdraw from their GPF after completing a specific duration of service, usually 10 years, though exceptions apply.

Temporary Employees and GPF

Temporary employees appointed for more than one year can also subscribe and withdraw under certain conditions, but permanent employees get priority in withdrawal approvals.

Rules and Regulations Governing GPF Withdrawals

General Rules for Withdrawals

Withdrawals can only be made for specific reasons sanctioned by the government. Also, there must be a minimum gap between two withdrawals unless it’s an emergency.

Maximum Withdrawal Limit

You can withdraw up to 90% of your total balance under most circumstances, especially for final withdrawals. For temporary advances, the limit is lower.

Circumstances for Non-Refundable Advances

You’re allowed non-refundable advances in cases like serious illness, education of children, or building/purchasing a home.

Purposes for Which GPF Withdrawal is Allowed

Medical Emergencies

Funds can be withdrawn for serious health conditions for self or dependent family members.

Higher Education

Children’s higher education—whether in India or abroad—is a valid reason for GPF withdrawal.

Marriage of Children

Marriage-related expenses of sons or daughters also qualify for non-refundable withdrawals.

House Construction or Purchase

Whether it’s buying a plot, constructing a house, or making major renovations—GPF is there to help.

Repayment of Loans

If you’ve taken loans for purposes like housing or education, you can use your GPF savings to pay them back.

Procedure for GPF Withdrawal

Step-by-Step Process

Filling the Application

First, you’ll need to fill out Form 101 or the designated withdrawal form with full details.

Submitting Documents

Attach all supporting documents like medical certificates, educational admission letters, or property papers.

Processing Time

Once submitted, the processing usually takes 10-20 working days, depending on your department’s speed.

Tax Implications of GPF Withdrawals

Is GPF Withdrawal Taxable?

Nope. GPF withdrawals are completely tax-free under current Indian tax laws, provided all conditions are met.

Exemptions and Conditions

Withdrawals before five years of service may attract tax if the account isn’t transferred or settled properly, but this rarely applies to government employees.

Common Mistakes to Avoid During GPF Withdrawals

Incomplete Documentation

Missing papers or improperly filled forms often lead to delays or rejection.

Wrong Purpose Mentioned

If your reason doesn’t match the approved list, your request may be denied.

Exceeding Withdrawal Limits

Always check your available balance and the allowed limit before applying.

Tips for a Smooth GPF Withdrawal Process

Plan Ahead

If you know you’ll need funds for an event like a wedding or education, plan your application early.

Consult Your Department

Speak to the finance or HR department for clarity and guidance through the process.

Maintain Clear Records

Keep digital and physical copies of every document you submit. You’ll thank yourself later.

Digital Advancements in GPF Withdrawals

Online Portals for GPF

Many government departments now allow you to apply for GPF withdrawals through their official portals.

E-filing and Status Tracking

Once your form is submitted, you can track its progress online—no more running from one desk to another!

Conclusion

Withdrawals from the General Provident Fund are a lifeline for government employees during key life events. Whether it’s an unexpected emergency or a planned milestone, GPF offers reliable financial support. By understanding the rules, procedures, and common pitfalls, you can ensure a smooth experience. Always stay informed, keep your paperwork in order, and don’t hesitate to ask for help when needed. Your GPF is not just a savings scheme—it’s your financial safety net.

FAQs

1. Can I make multiple withdrawals from my GPF account?

Yes, but you must justify the need and ensure a minimum gap between withdrawals unless it’s an emergency.

2. How often can I withdraw from GPF?

There are no fixed limits, but repeated withdrawals without proper reasons might raise red flags.

3. Is there a penalty for early withdrawal?

Not exactly a penalty, but withdrawals before the required service period might be restricted or considered as loans.

4. Can I withdraw for personal leisure or vacation?

No, GPF withdrawals are only allowed for specific, approved purposes like education, marriage, or health.

5. What happens to GPF during retirement?

At retirement, the entire GPF balance is paid out to the employee tax-free as part of their final settlement.

Please don’t forget to leave a review.

Disclaimer:

This blog post is intended for informational purposes only. All rights, references, and credits related to official government service rules and guidelines belong to Swamy’s Publications, the authoritative source on these matters. We acknowledge and extend our courtesy to Swamy’s Publication for their valuable work in compiling and publishing official content. This blog does not claim ownership or authorship of any content originally published by Swamy’s Publications.

For more information and updates please follow the page and don’t forget to leave your comment.