Leave Travel Concession (LTC) Rules for Central Government Employees from Swamy’s Handbook

Leave Travel Concession (LTC) is a significant welfare measure extended to Central Government employees, enabling them to travel with their families and rejuvenate while also promoting domestic tourism. As per the consolidated guidelines presented in the Swamy’s Handbook, LTC is governed by specific eligibility criteria, procedural requirements, and entitlements that ensure a standardized and transparent mechanism for availing this facility. This article comprehensively explains the latest LTC rules for Central Government employees as per the provisions of the Swamy’s Handbook 2025 edition, highlighting its benefits, eligibility, concessions, and important procedural aspects.

LTC is available to Central Government employees who have completed one year of continuous service. It allows them to travel to their hometown or any place within India as per their entitlements during a block of four years. The main objective is to grant employees time off with their families for vacation or personal visits while being reimbursed for the travel fare incurred, subject to conditions. The scheme covers the employee, their spouse, children (up to a certain age and number), and dependent family members, including parents and siblings under specific conditions.

There are two primary types of LTC—Home Town LTC and All India LTC. Home Town LTC can be availed once every two years or twice in a four-year block, while All India LTC can be availed once in a four-year block in lieu of one Home Town LTC. A notable clause in Swamy’s Handbook is the detailed explanation of LTC blocks. The current four-year blocks are defined as 2022–2025, 2026–2029, and so on. If an employee fails to avail LTC in a block period, carry-forward of one block for one year is permissible, i.e., until the end of the following year.

Under Rule 6 of the CCS (LTC) Rules, 1988, the reimbursement of fare is allowed for travel by the shortest route and by the authorized class of travel. The entitlement of travel class depends on the employee’s grade pay or pay level. For example, officers in Pay Level 9 and above are eligible to travel by air (economy class), while lower-level employees may be entitled to AC-II or AC-III tier rail travel. The Swamy’s Handbook lays out a clear table for entitlements, which helps in avoiding ambiguity regarding admissible mode and class of travel.

It is crucial to note that LTC is admissible only for travel within Indian territory, and no foreign travel is reimbursed under LTC. The Government of India has also introduced various initiatives under LTC, such as the LTC-80 scheme, allowing air travel by Air India on government-approved rates for specific destinations, particularly those in the North-East Region (NER), Jammu & Kashmir, Ladakh, Andaman & Nicobar Islands, and other remote areas. This is known as the Special Concession LTC, where employees, regardless of eligibility for air travel, can travel by air to these destinations under specific relaxation orders issued by the Department of Personnel & Training (DoPT).

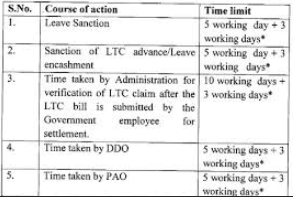

The LTC journey must commence and end within the specified block period, and employees are required to submit a LTC claim form, along with travel tickets, boarding passes, and a self-declaration that no fraudulent claim has been made. As per Swamy’s guidelines, employees must also obtain prior sanction from the competent authority before undertaking the journey. Failure to comply may lead to rejection of the claim.

Disclaimer:

This blog post is intended for informational purposes only. All rights, references, and credits related to official government service rules and guidelines belong to Swamy’s Publications, the authoritative source on these matters. We acknowledge and extend our courtesy to Swamy’s Publication for their valuable work in compiling and publishing official content. This blog does not claim ownership or authorship of any content originally published by Swamy’s Publications.

Another vital rule is the deemed surrender of earned leave. For every LTC availed, the employee is deemed to have surrendered ten days of earned leave, even if leave was not actually taken. The encashment of these ten days is permissible along with LTC for up to 60 days during the entire service. This provision encourages employees to travel without necessarily exhausting their leave balance and provides a financial benefit through leave encashment.

LTC is not available during suspension or for employees under disciplinary proceedings. Additionally, contractual employees and temporary staff (not regularized) are generally not eligible unless specific provisions are made in their contract. The rules also restrict multiple claims for the same journey, meaning duplicate reimbursement through any other source (e.g., State Government, PSU, or autonomous body) is not allowed.

Swamy’s Handbook 2025 also details provisions for LTC advance, allowing employees to draw up to 90% of the estimated fare in advance. This helps in planning and reducing out-of-pocket expenses. The claim, however, must be settled within one month of completion of the journey, failing which interest is charged on the advance amount.

The government has periodically introduced LTC Cash Voucher Schemes, especially during economic slowdowns, where employees forgo actual travel and receive reimbursement upon spending a specified amount on goods and services attracting GST of 12% or more. Though temporary in nature, these schemes have been clarified and detailed in Swamy’s publications whenever in force.

Misuse of LTC is viewed seriously. Any false declaration or forged claim attracts disciplinary action, including recovery of amount, interest, penalties, and even suspension. Therefore, Swamy’s Handbook stresses adherence to procedural formalities, timely claim submissions, and accurate documentation.

In conclusion, Leave Travel Concession (LTC) as per Swamy’s Handbook is a well-defined and beneficial facility for Central Government employees that promotes travel, work-life balance, and family bonding. With clear entitlements, eligibility, and guidelines, it remains a vital welfare measure. Proper understanding and compliance with LTC rules ensure not only financial reimbursement but also a stress-free and lawful travel experience for the employees and their families. The Swamy’s Handbook continues to serve as a trusted and authoritative guide for decoding the nuances of LTC and other service rules for Central Government personnel.

For more information and updates please follow the page and don’t forget to leave your comment.

Disclaimer:

This blog post is intended for informational purposes only. All rights, references, and credits related to official government service rules and guidelines belong to Swamy’s Publications, the authoritative source on these matters. We acknowledge and extend our courtesy to Swamy’s Publication for their valuable work in compiling and publishing official content. This blog does not claim ownership or authorship of any content originally published by Swamy’s Publications.