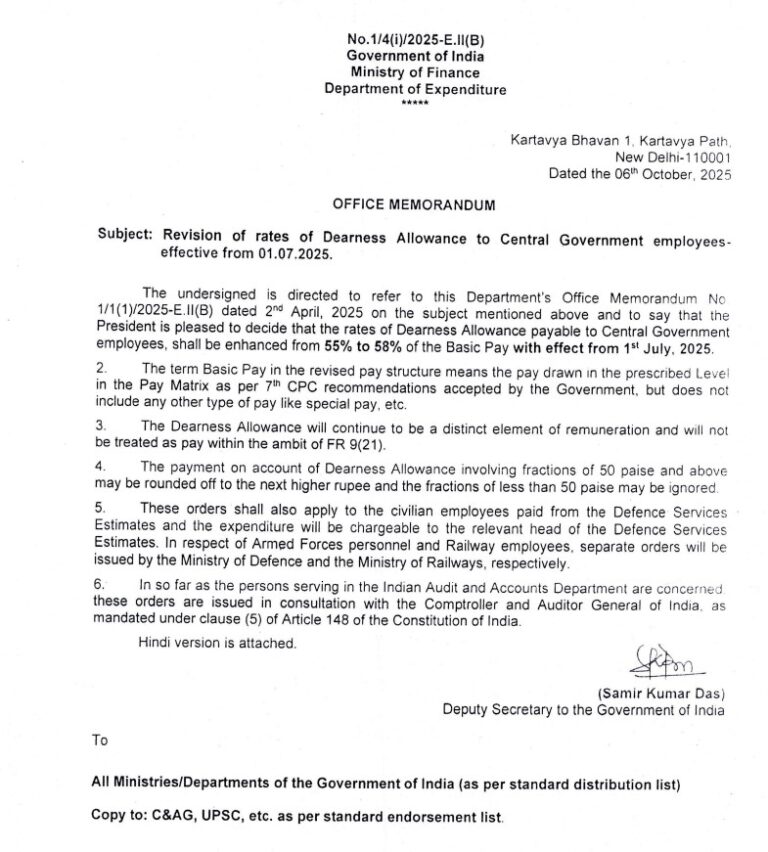

Revision of Rates of Dearness Allowance to Central Government Employees Effective from 01.07.2025

Revision of Dearness Allowance (DA) for Central Government employees, granting a 3% increase, thereby raising the DA from 55% to 58% of the Basic Pay, effective from 1st July 2025. This decision, taken by the Union Cabinet, marks a significant step in supporting employees and pensioners amid rising inflation and increasing cost of living. The revision not only enhances the financial well-being of millions of government employees but also reinforces the government’s commitment to ensuring economic stability for its workforce.

Understanding the Importance of Dearness Allowance

The Dearness Allowance (DA) is an essential component of the salary structure for Central Government employees. It was introduced to offset the impact of inflation on the real income of employees. Over time, as the cost of goods and services rises, the DA serves as a crucial safeguard, maintaining the purchasing power of salaries. Calculated based on the All India Consumer Price Index for Industrial Workers (AICPI-IW), the DA is revised twice a year — usually in January and July — to align with changes in inflation rates.

By raising the DA from 55% to 58%, the government aims to ensure that employees’ real earnings are not eroded by inflationary pressures. This increase will be reflected in the pay slips of employees starting from July 2025, and it is expected to bring financial relief to lakhs of serving and retired government personnel.

Effective Date and Payment of Arrears

The newly revised DA rates will come into effect from 1st July 2025, and all arrears will be paid retrospectively from the same date. Employees and pensioners will receive the accumulated arrears for the months between July 2025 and the current payment cycle date, providing a significant one-time financial benefit. The arrears will be credited to the respective bank accounts as per departmental procedures. This ensures timely disbursement and transparency across all ministries and government offices.

DA Hike from 55% to 58%: What It Means

The 3% hike in DA brings the overall rate to 58% of the Basic Pay, effective from 1st July 2025. This increase, though seemingly small, has a large cumulative effect on both salaries and pensions. For instance, an employee with a basic pay of ₹50,000 will now receive ₹29,000 as DA instead of ₹27,500 — an additional ₹1,500 every month. Pensioners will also see a corresponding rise in Dearness Relief (DR), ensuring equal benefits across both active and retired personnel.

This revision has been approved following the standard review of inflation data and the Consumer Price Index for Industrial Workers (CPI-IW). The upward trend in inflation over the past six months justified this increase, ensuring that government employees are adequately compensated for the rise in living costs.

Beneficiaries of the DA Revision

The decision to enhance DA benefits approximately 48 lakh Central Government employees and 68 lakh pensioners across India. This includes personnel from:

Civil services and administrative departments

Defence forces

Railways

Central public sector undertakings following Central pay scales

Autonomous and statutory bodies governed by the Central Government

Pensioners and family pensioners will receive equivalent Dearness Relief (DR) to maintain parity in benefits, as per established government policies.

How DA Impacts Salaries and Pensions

The DA increase has a cascading effect on various components of salary and pension. While the DA itself is calculated as a percentage of basic pay, certain allowances and retirement benefits are linked to it. For employees nearing retirement, the higher DA can also influence the gratuity and leave encashment amounts. Similarly, pensioners will experience a direct increase in monthly pension payouts, ensuring financial stability post-retirement.

Moreover, when DA crosses certain thresholds — for instance, 50% — it often triggers the merger of DA with basic pay, which eventually leads to higher pay scales and other related allowances. Though the current DA rate of 58% is not yet at the merger threshold, it represents steady progress in employee compensation.

Government’s Commitment to Employee Welfare

The DA hike is part of the government’s continuous effort to improve the financial well-being of its employees and retirees. Despite fiscal constraints, the decision demonstrates a strong commitment to balancing economic management with employee welfare. It acknowledges the valuable contribution of government staff in maintaining administrative efficiency and national growth.

Such revisions also play a crucial role in boosting morale among employees. They serve as a reminder that the government recognises the challenges faced by its workforce due to inflation and economic volatility. The 3% increase, therefore, is not just a financial adjustment but a reassurance of the government’s dedication to its people.

Fiscal Impact and Economic Considerations

While beneficial to employees, every DA revision has a significant fiscal impact on the national budget. The combined annual financial implication of this 3% DA increase is estimated to be several thousand crores. However, the government carefully evaluates inflation data, budgetary constraints, and economic trends before finalizing such revisions. This ensures that the decision is sustainable and aligns with the country’s broader economic objectives.

Economists believe that this increase will also have a positive impact on the economy by increasing disposable income and, in turn, boosting consumption. The rise in DA effectively injects more money into the economy, helping maintain demand in key sectors.

How the DA Is Calculated

The DA is calculated based on the following formula prescribed by the 7th Central Pay Commission (CPC):

DA (%) = [(Average CPI-IW for the past 12 months – 115.76) / 115.76] × 100

This formula ensures that DA revisions accurately reflect the real inflation trends. The Labour Bureau compiles the CPI-IW data every month, and the Ministry of Finance uses this information to calculate the next DA installment.

Comparison with Previous Revisions

The DA has seen consistent increases over the years in response to inflation:

January 2023: Increased from 38% to 42%

July 2023: Increased from 42% to 46%

January 2024: Increased to 50%, triggering merger with basic pay

January 2025: Raised to 55%

July 2025: Further increased to 58%

This steady growth demonstrates the government’s proactive approach to maintaining financial parity for employees amidst inflationary trends.

How Employees Can Access DA Notifications

Employees can view official DA notifications on the Department of Expenditure (DoE) website under the Ministry of Finance. The notification, usually issued as an Office Memorandum (OM), details the effective date, rate of increase, and applicable beneficiaries. It’s always advisable for employees and pensioners to refer to these official documents to confirm eligibility and calculation details.

Conclusion

The Revision of Rates of Dearness Allowance to Central Government Employees effective from 01.07.2025, increasing the DA from 55% to 58%, is a welcome move that underscores the government’s continued support for its employees and pensioners. The 3% hike, coupled with arrears payable from July 2025, brings tangible financial relief and strengthens the economic stability of millions of families. This step reaffirms the government’s resolve to ensure that the standard of living for its workforce is maintained despite inflationary challenges. With this adjustment, the government once again demonstrates that it values the dedication, hard work, and service of its employees across the nation.

FAQs

Q1. What is the revised DA rate from 1st July 2025?

The DA has been increased by 3%, raising it from 55% to 58% of the Basic Pay, effective 1st July 2025.

Q2. Who will benefit from this DA revision?

All Central Government employees, pensioners, and family pensioners will benefit from the increase.

Q3. Will arrears be paid for this DA increase?

Yes, all arrears from 1st July 2025 till the date of implementation will be paid to employees and pensioners.

Q4. How is DA calculated?

DA is calculated based on the Consumer Price Index for Industrial Workers (CPI-IW) using the formula prescribed by the 7th Central Pay Commission.

Q5. When is the next DA revision expected?

The next DA revision is expected in January 2026, following the standard six-month review cycle.

Please don’t forget to leave a review.

Disclaimer:

The information provided in this article regarding the “Revision of Rates of Dearness Allowance to Central Government Employees effective from 01.07.2025” is intended solely for general informational purposes. While every effort has been made to ensure accuracy, readers are advised to refer to official notifications and circulars issued by the Government of India and the Ministry of Finance for the most authentic and updated details. The author or publisher assumes no responsibility for any errors, omissions, or discrepancies that may occur. This content should not be treated as official government communication or legal advice.

For more information and updates please follow the page and don’t forget to leave your comment.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/pt-PT/register?ref=KDN7HDOR