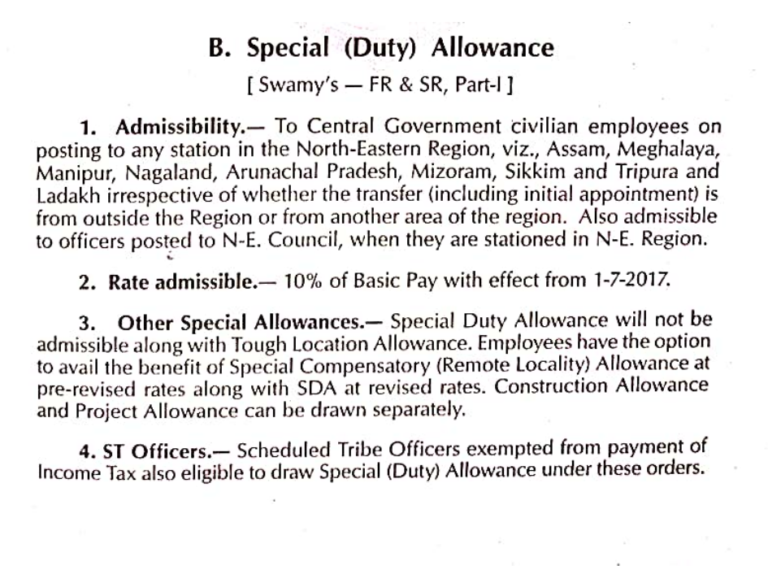

Special Duty Allowance

Special Duty Allowance (SDA) is more than just a monetary benefit—it’s a recognition of sacrifice, endurance, and commitment. Whether you’re braving the freezing cold in Ladakh or adapting to the dense forests of the North East, SDA is the government’s way of saying, “We see your hardship, and we value it.”

What is Special Duty Allowance?

SDA is a type of compensatory allowance given to certain government employees who are posted in difficult or remote areas, where living and working conditions are significantly tougher than usual. It’s especially common among those in the armed forces, civil services, and central government sectors.

History and Evolution of SDA

Initially introduced for armed forces personnel posted in border or high-risk areas, SDA has evolved over time to include civil servants and other central government employees. With each Pay Commission review, the scope, rate, and eligibility criteria of SDA have seen changes, aiming to make it more inclusive and fair.

The Purpose of SDA

Why is SDA Granted?

The core reason behind SDA is simple—it’s about fairness. Employees who serve in regions that are cut off from urban infrastructure or are physically challenging deserve compensation.

Compensating for Hardship

Imagine dealing with limited connectivity, harsh weather, and a lack of basic amenities. SDA steps in to bridge that discomfort gap.

Motivation for Remote Postings

No one jumps at the chance of being posted in remote corners of the country. SDA adds a financial incentive to make such assignments more palatable.

Eligibility for SDA

Who Can Receive SDA?

SDA is not for everyone. It’s targeted at specific employees under specific conditions.

Central Government Employees

Employees from central ministries posted in challenging locations are eligible, particularly those in Group A, B, and sometimes C services.

Armed Forces and Paramilitary Personnel

Personnel from the Indian Army, Navy, Air Force, CRPF, and BSF often receive SDA for their services in border and high-altitude zones.

SDA and Its Geographical Relevance

Regions Where SDA is Applicable

SDA is primarily offered in areas where natural challenges or political sensitivities make life harder.

North East India

States like Assam, Manipur, Mizoram, and Nagaland are some of the prominent recipients of SDA due to insurgency, difficult terrain, and isolation.

Andaman and Nicobar Islands

Life on islands with limited accessibility comes with its own challenges, justifying the SDA.

Ladakh and Other Difficult Terrains

Extremely cold temperatures, altitude sickness, and limited access to healthcare in places like Leh and Kargil make SDA essential.

SDA Rates and Calculation

How is SDA Calculated?

It is calculated as a percentage of basic pay, and the percentage varies based on the department and location.

Percentage-Based Method

Typically ranges between 10% to 12.5% of the basic salary, depending on eligibility and posting.

Salary Components Included

SDA is usually added to basic pay, which then influences other salary benefits like HRA and DA.

SDA vs. Other Allowances

SDA vs. Hardship Allowance

While both serve similar purposes, hardship allowance is usually for high-risk zones (like Siachen) whereas SDA is more broadly applied.

SDA vs. Field Area Allowance

Field Area Allowance is more military-specific and tactical, while SDA spans both military and civil services.

Controversies and Debates Surrounding SDA

Equality Among Employees

One of the biggest debates is the fairness of excluding certain employee groups, leading to resentment and demands for revision.

Demands for SDA in Other Regions

States like Jammu & Kashmir and certain tribal regions have long demanded SDA recognition due to similar conditions.

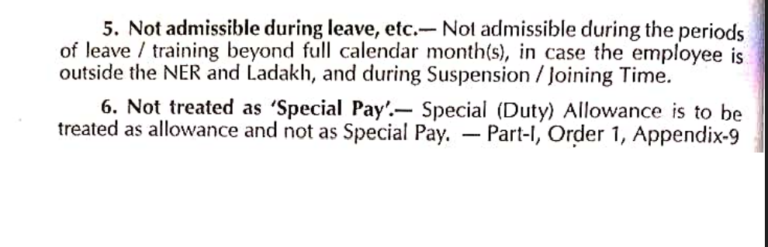

The Impact of SDA

Employee Morale and Retention

Employees who receive SDA feel more appreciated, which boosts morale and reduces transfer resistance.

Recruitment in Remote Areas

SDA acts as a great recruiting tool for roles in neglected or underdeveloped regions.

Government Policies and Revisions

6th and 7th Pay Commission Recommendations

The 7th Pay Commission rationalized SDA, suggesting uniform rates and broader coverage.

Recent Policy Updates

Post-7th CPC, SDA rates were revised, and efforts were made to streamline the allowance across services.

Challenges in Implementing SDA

Budget Constraints

Allocating additional funds for SDA in every budget cycle remains a tough balancing act for the finance ministry.

Administrative Bottlenecks

Delays in approval, disbursement, and eligibility disputes often slow down the SDA process.

Case Studies

SDA in the Indian Armed Forces

Soldiers posted in Tawang or Leh receive SDA as part of their hardship compensation, significantly boosting their net salary.

SDA for Civil Services in the North East

IAS and IPS officers serving in Assam and Meghalaya often share how SDA has helped them cope financially with isolation and lack of resources.

SDA from Employees’ Perspective

Testimonials and Real-Life Experiences

Many employees express that while the money helps, the gesture of recognizing their effort is what truly counts.

Future of SDA

Potential Expansions and Modifications

There’s ongoing talk about extending SDA to other neglected regions and refining eligibility rules to include more job categories.

Summary and Final Thoughts

Special Duty Allowance may seem like a line item in a salary slip, but it plays a huge role in national administration and defense. It recognizes grit, encourages service in tough terrains, and ensures that no region is left behind due to lack of manpower. As India grows, so must the compassion in its policies—and SDA is one such compassionate move.

FAQs

What is the current rate of SDA?

The current rate generally ranges from 10% to 12.5% of the basic salary, based on the 7th Pay Commission.

Is SDA taxable?

Yes, SDA is fully taxable as it is considered part of your salary income.

Can private employees claim SDA?

No, SDA is strictly for government employees serving in designated remote or difficult areas.

How often is SDA reviewed?

SDA is reviewed during each Pay Commission cycle or through special government notifications.

Does SDA affect pension benefits?

While it contributes to salary during service, SDA is not counted in pension calculations post-retirement.

Please don’t forget to leave a review.

Disclaimer:

This blog post is intended for informational purposes only. All rights, references, and credits related to official government service rules and guidelines belong to Swamy’s Publications, the authoritative source on these matters. We acknowledge and extend our courtesy to Swamy’s Publication for their valuable work in compiling and publishing official content. This blog does not claim ownership or authorship of any content originally published by Swamy’s Publications.

For more information and updates please follow the page and don’t forget to leave your comment.