Conveyance Allowance for Central Govt Employees in IndiaConveyance Allowance for Central Government Employees in India

Introduction to Conveyance Allowance

If you’re a central government employee in India, you probably know how hectic daily travel can be. That’s where conveyance allowance steps in—a small yet significant financial relief that supports employees commuting between home and work or during field assignments.

What is Conveyance Allowance?

Conveyance Allowance is a fixed amount paid to employees to compensate for the cost of travel, usually between home and workplace. It is a non-performance-based allowance, meaning it doesn’t depend on the output or work quality, but rather on the requirement of regular travel.

Importance for Government Employees

With rising fuel prices and increased transportation costs, this allowance helps ease financial pressure. It’s especially valuable for those working in roles that demand frequent movement outside the office premises.

Eligibility Criteria

Who is Eligible?

Generally, all central government employees who are required to commute regularly or perform field duties are eligible. This includes officers, clerks, drivers, and more.

Categories of Employees Covered

Group A to Group D employees

Staff using personal vehicles for office duty

Employees with physical disabilities (additional support available)

Types of Allowances Related to Travel

Conveyance Allowance vs Transport Allowance

While these terms are often used interchangeably, they are distinct. Transport Allowance is generally for daily home-to-office travel, whereas Conveyance Allowance may also cover local travel for official duties.

Daily Travel Reimbursement

Employees who travel occasionally for work can claim actual reimbursement based on bills, separate from the monthly fixed conveyance.

LTC (Leave Travel Concession)

While not directly the same, LTC is another travel-related allowance that helps employees cover travel costs when on leave.

Latest Rules and Updates

7th Pay Commission Insights

The 7th Central Pay Commission suggested rationalizing allowances, including conveyance. While base rates were adjusted, disabled employees continued receiving enhanced rates.

Recent Notifications and Revisions

There have been no drastic changes post-7th CPC, but periodic updates ensure it stays aligned with inflation and travel cost trends.

Conveyance Allowance Amount

Fixed Monthly Rates

Rates vary depending on designation, distance traveled, and the nature of duties. As of recent data:

₹1600 per month for general employees

₹3200 per month for specific roles and differently-abled employees

Rates Based on Disability (PWD employees)

PWD (Persons with Disabilities) employees are entitled to higher transport allowance due to additional mobility challenges.

Tax Implications

Is Conveyance Allowance Taxable?

Yes, it can be. But under Section 10(14)(ii) of the Income Tax Act, up to ₹1600/month is tax-exempt for regular employees.

Income Tax Exemptions

PWD employees can enjoy ₹3200/month exemption, subject to fulfilling conditions.

How to Claim Conveyance Allowance

Required Documents

Duty certificates

Travel logbook (if applicable)

Declaration of personal transport usage

Steps to Apply

Submit claim form through the administrative office

Attach necessary documents

Get approval and wait for monthly credit

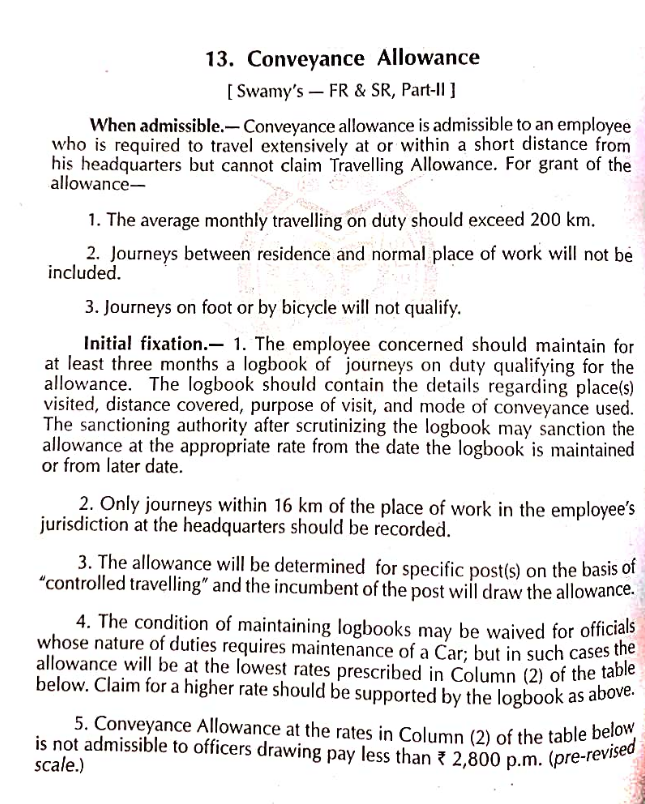

Click here to check Entitlements and Rates

Digital Reimbursement Platforms

Online Tools and Portals

The government is gradually moving toward digital processing, where claims can be submitted via departmental portals.

eHRMS System Overview

eHRMS (Electronic Human Resource Management System) allows employees to track, apply, and get updates about allowances digitally.

Issues and Complaints

Common Delays

Some employees report delays in processing due to paperwork errors or lack of digital systems.

Whom to Contact

Grievances can be submitted to the department head or via CPGRAMS (Centralized Public Grievance Redress and Monitoring System).

Role of DOPT and Finance Ministry

Policy Making and Implementation

The Department of Personnel & Training (DoPT) and Ministry of Finance jointly design policies around allowances.

Circulars and Guidelines

Official circulars are released on their websites and should be referred to for the latest changes.

Conveyance Allowance for Special Categories

Differently-Abled Employees

They receive enhanced rates and may not need to provide proof of travel in some cases.

Field Workers and Outdoor Staff

These employees may receive variable conveyance based on duty nature and travel logs.

Benefits of Conveyance Allowance

Financial Relief

Covers a part of monthly transportation expenses, especially for lower-income staff.

Motivation and Productivity

A fair conveyance policy encourages better performance and job satisfaction.

Common Myths and Misunderstandings

Misconceptions About Eligibility

Some think only senior officers qualify—not true. Many junior staff are eligible too.

Clarification from Official Guidelines

Always refer to official government circulars to avoid confusion and misinterpretation.

Suggestions for Improvement

From Employee Feedback

Many employees suggest streamlined digital processing and regular rate updates.

Tech-Based Solutions

Government could consider a centralized mobile app for allowance tracking and claims.

Click here to check Entitlements and Rates

Conclusion

Conveyance Allowance may seem like a small component of a government employee’s salary package, but it plays a huge role in improving ease of work and financial comfort. From fixed rates to special provisions for PWDs, it’s tailored to support the diverse workforce of the Indian government. Staying informed and proactive about claiming what you’re entitled to can make a noticeable difference in your monthly budget.

FAQs

1. What is the current conveyance allowance for central govt employees?

As per the latest available data, it’s ₹1600/month for most employees and ₹3200/month for PWD employees.

2. Is it taxable for all categories of employees?

No, up to ₹1600 (or ₹3200 for PWD) is tax-exempt under Section 10 of the Income Tax Act.

3. How can one claim this allowance?

By submitting a claim form, duty certificates, and required documentation to the administrative office or via eHRMS.

4. What if an employee doesn’t use personal transport?

They may not be eligible for the fixed conveyance but can still claim official travel reimbursements.

5. Are pensioners eligible for conveyance allowance?

No, conveyance allowance is meant for active employees currently on duty.

Please don’t forget to leave a review.

Click here to Download in PDF

Click here to check Entitlements and Rates

Disclaimer:

This blog post is intended for informational purposes only. All rights, references, and credits related to official government service rules and guidelines belong to Swamy’s Publications, the authoritative source on these matters. We acknowledge and extend our courtesy to Swamy’s Publication for their valuable work in compiling and publishing official content. This blog does not claim ownership or authorship of any content originally published by Swamy’s Publications.

For more information and updates please follow the page and don’t forget to leave your comment.