Transport Allowance

In today’s fast-paced work environment, where daily commuting has become an unavoidable reality, transport allowance plays a vital role in supporting employees across various sectors. Whether in the public or private domain, transport allowance has emerged as an essential component of the salary structure, helping employees meet the expenses associated with commuting from home to the workplace and vice versa. With rising fuel prices and congested urban traffic, this allowance not only eases financial burdens but also reflects an organization’s commitment to employee welfare.

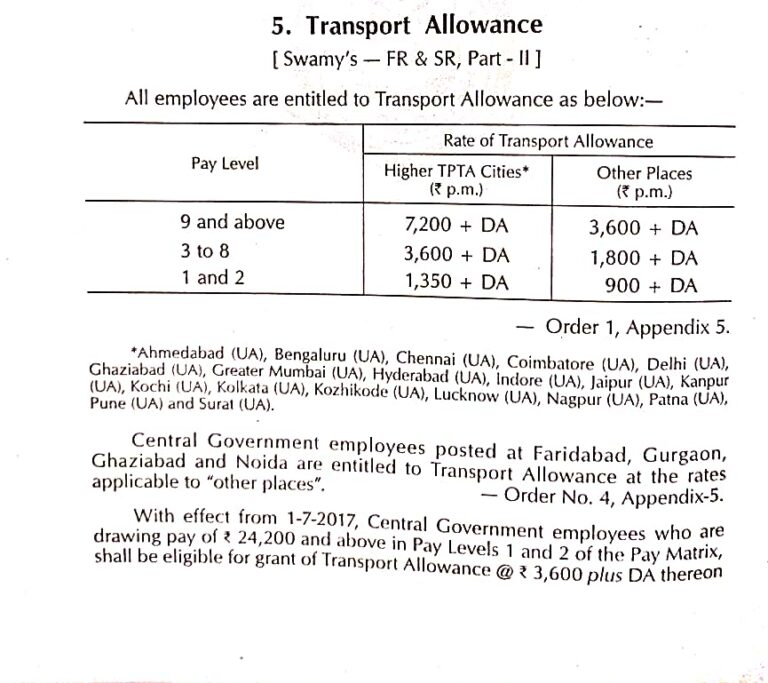

Transport allowance is particularly significant for employees posted in metropolitan cities, where the cost of living is high, and public transport expenses can form a considerable portion of monthly budgets. Government employees in India are among the primary beneficiaries of transport allowance, which is governed by detailed guidelines set forth by the Central Government and revised periodically based on Pay Commission recommendations. For instance, after the 7th Central Pay Commission (CPC), the transport allowance rates were revised to ensure they meet current economic conditions and inflationary pressures.

At its core, transport allowance is designed to cover the costs of commuting using public or private transport. The allowance amount typically varies depending on the employee’s grade pay, place of posting (metro or non-metro city), and special conditions like physical disability. Employees with disabilities are often entitled to a higher rate of transport allowance, recognizing the additional challenges they face during daily travel.

In Central Government services, the transport allowance is exempt from income tax up to a certain limit. As per Section 10(14)(ii) of the Income Tax Act, 1961, read with Rule 2BB of the Income Tax Rules, the exemption is up to ₹1,600 per month for regular employees and ₹3,200 per month for employees who are blind, deaf and dumb, or orthopedically handicapped with disability in lower extremities. This exemption not only makes the allowance more valuable but also ensures that employees receive maximum benefit without heavy tax deductions.

Moreover, the transport allowance is disbursed irrespective of whether the employee uses public or personal means of transport, making it flexible and inclusive. However, there are certain conditions, such as eligibility being restricted to employees who are not provided with government transport. If a department provides official transport for commuting, the transport allowance may not be applicable.

One of the notable aspects of transport allowance is its consistency. Unlike conveyance reimbursements which require submission of fuel bills or travel logs, transport allowance is fixed and paid monthly along with the salary. This simplifies accounting and offers employees a predictable financial aid that they can rely on each month.

In recent times, many private sector companies have also adopted similar practices, offering fixed or variable transport allowances to retain talent and improve employee satisfaction. For organizations located in IT hubs, industrial zones, or areas with limited public transport options, transport allowance is often bundled with other benefits such as pick-up and drop-off services, vehicle leasing options, or fuel cards. These flexible arrangements provide employees with choices that suit their lifestyle and commuting preferences.

During the COVID-19 pandemic, when work-from-home became the norm, many employers temporarily withheld or modified transport allowance disbursements. However, with the gradual return to office culture, the relevance of this benefit has resurfaced, and many HR policies have been updated to reinstate or enhance transport allowances in line with hybrid work models.

From a human resources and policy perspective, transport allowance also serves as a motivational tool. By helping employees save on commuting expenses, organizations indirectly contribute to job satisfaction and work-life balance. Employees who feel their needs are acknowledged are likely to show greater commitment and loyalty towards their employers.

Looking ahead, as cities grow larger and commutes become longer, the importance of transport allowance will only increase. It will remain an essential part of salary structures, especially in sectors like education, healthcare, administration, and IT services, where employee mobility is critical. For employees, it’s a practical support system that enables them to focus on their work without worrying about the financial strain of daily travel.

In conclusion, transport allowance is much more than a monetary benefit—it’s a gesture of consideration towards the daily efforts of employees. It reflects organizational sensitivity to real-life challenges and plays a role in creating a more supportive and productive work environment. As workplaces continue to evolve, such benefits will remain central to shaping a responsive and employee-friendly corporate culture.

Please don’t forget to leave a review.

For more information and updates please follow the page and don’t forget to leave your comment.

Disclaimer:

This blog post is intended for informational purposes only. All rights, references, and credits related to official government service rules and guidelines belong to Swamy’s Publications, the authoritative source on these matters. We acknowledge and extend our courtesy to Swamy’s Publication for their valuable work in compiling and publishing official content. This blog does not claim ownership or authorship of any content originally published by Swamy’s Publications.

For more information and updates please follow the page and don’t forget to leave your comment.